WE'RE REBUILDING RIGHT NOW.

CHECK BACK AGAIN SOON.

Close 5-15+ Deals Each Month, Using This AI-Backed, Automated Sequential Marketing CRM

Without Inexperienced Virtual Assistants, Cold Calling Your Life Away, or Going Broke Sending Direct Mail and/or Buying Ads

Here's what you'll discover in

this free training

Explore how our automated marketing CRM lets you automate your SMS, RVM, email, & social media marketing to your target market to get more motivated seller leads and close more deals virtually on auto-pilot

Learn how this automated marketing CRM is outshining

all other CRMs in the market by letting you enjoy the freedom and peace of mind you deserve on all your marketing campaignsDiscover how to utilize automated to capture, track, and nurture your leads until they are closed deals

Find out how you can unleash the power of this automated marketing CRM to keep a track of lead generation, conversion rates, and your prospects’ behavior

How you can easily monitor the marketing pipeline from initial contact to closed deal

Finally, unlock the secrets of our never before revealed sequential marketing techniques that guarantees you more closed deals in half the time with half the money

Would you miss a chance to learn from an industry expert? One who, himself, is a real estate investor and has designed this system to help the real estate investors just like you to unlock the secrets of Automated Sequential Marketing.

You won’t find a system like this anywhere else that will work with this level of ease to start

bringing the dollars to your pockets

without requiring you to even

lifting a finger!

Lifetime Deal Ends In...

Lifetime Deal Ends In...

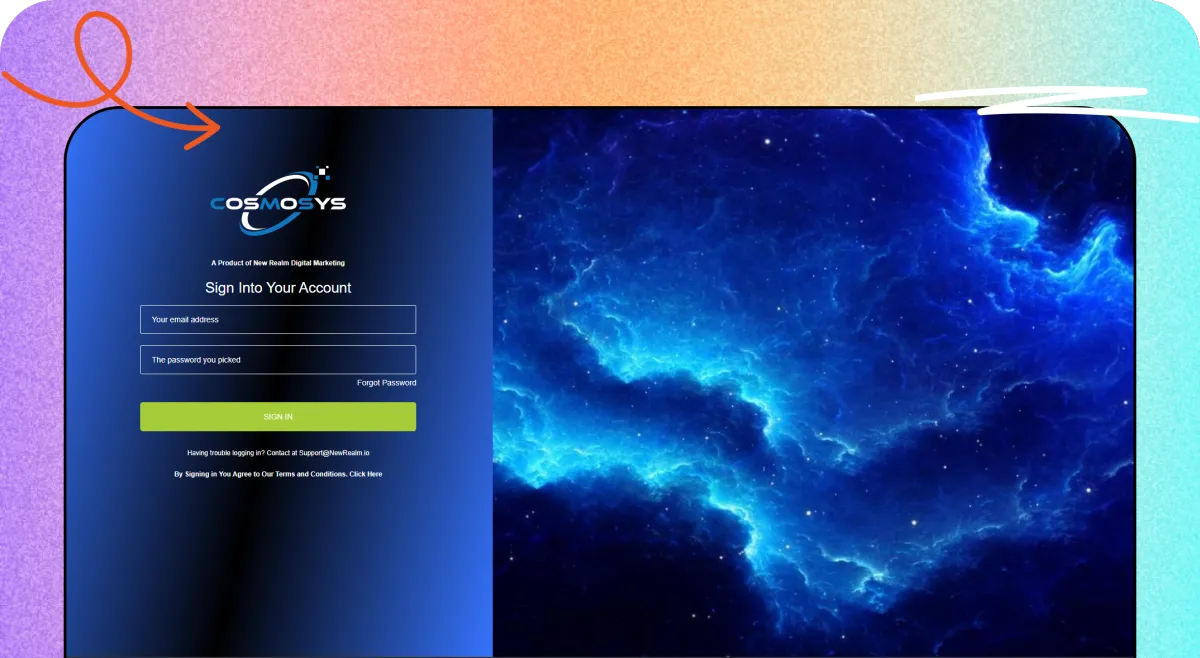

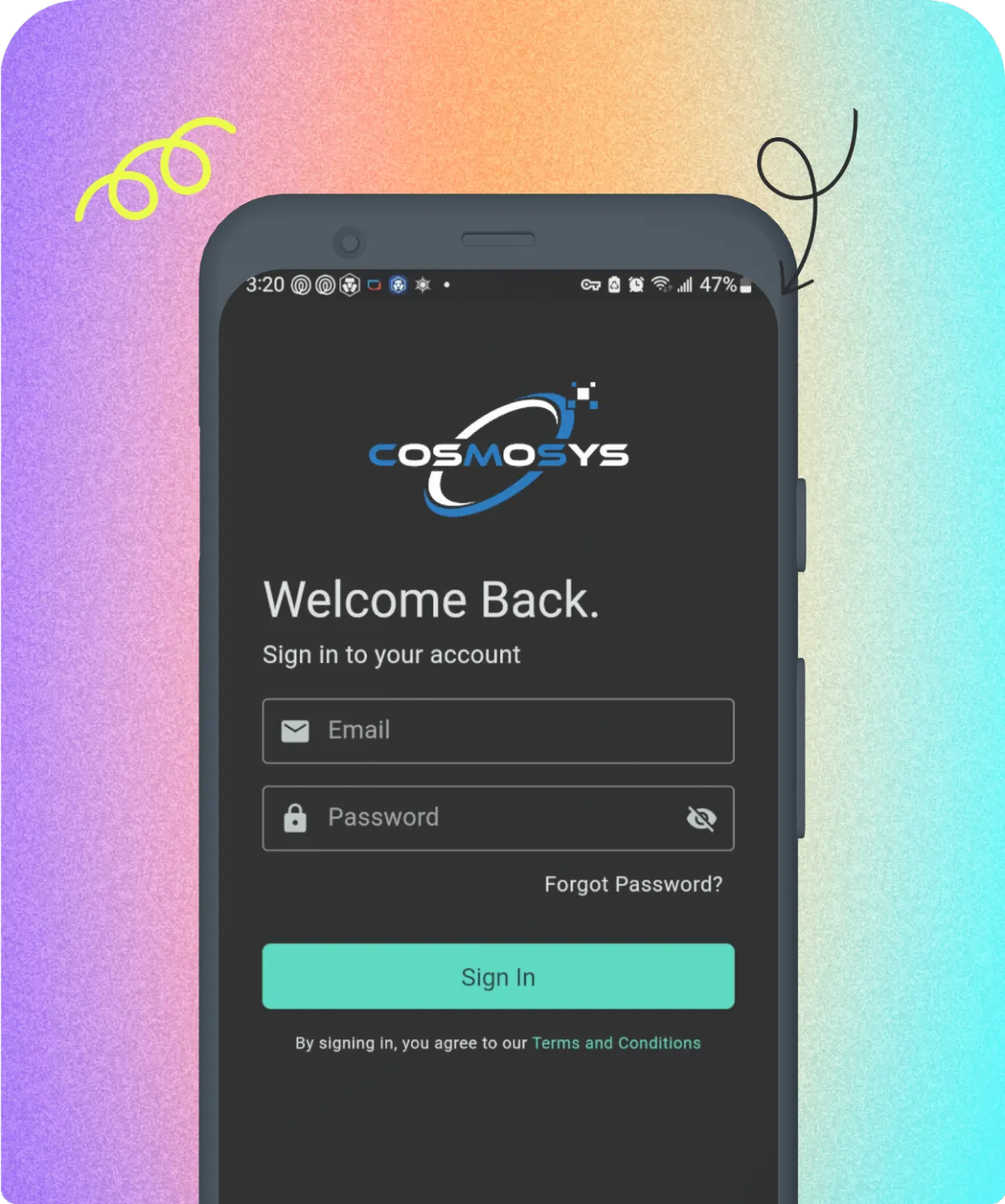

Input your details to access a free demo now

Other Investor's Thoughts

Hear what other Investors are saying...

Other Investor's Thoughts

Hear what other Investors are saying...

CosMoSys AI | Copyright

2025 | All Rights Reserved

CosMoSys AI | Copyright

2025 | All Rights Reserved